No doubt many readers have heard of “job lock,” the incentive to stay in a current job for the health insurance benefits, even if another job (or no job) may be preferable for other reasons. Well, there seems to be an “entrepreneurship lock” too. Fewer new businesses are started due to the cost and uncertainly associated with transitioning from a current position, with good benefits, to the head of a start-up.

Robert W. Fairlie, Kanika Kapur, and Susan Gates investigated (ungated working paper here):

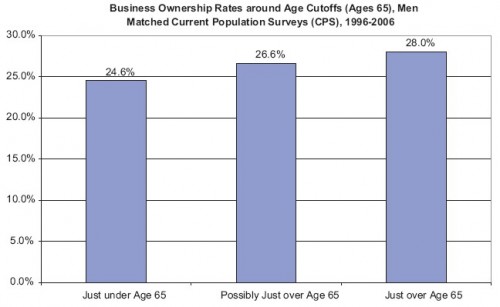

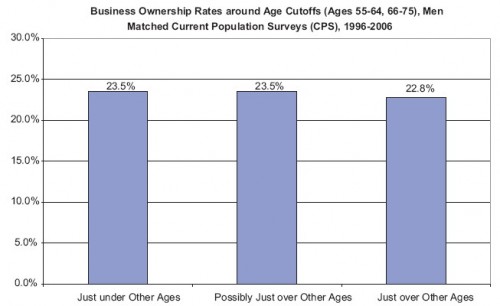

[W]e compare the probability of business ownership among male workers in the months just before turning age 65 and in the months just after turning age 65. Business ownership rates increase from 24.6% for those just under age 65 to 28.0% for those just over age 65, whereas we find no change in business ownership rates from just before to just after for the remaining ages in our sample of workers ages 55–75. We estimate several regression discontinuity models to confirm these results. As expected because of the small change in actual age and the orthogonality of included controls, we find a similarly large and statistically significant increase in business ownership rates in the age 65 birth month when the worker qualifies for Medicare. These results are not sensitive to several alternative samples, dependent variables, and age functions, and we do not find evidence from previous studies and additional specifications that other factors such as retirement, partial retirement, social security and pension eligibility are responsible for the increase in business ownership rates in the month the individual turns 65 and qualifies for Medicare.

Here it is in pictures:

That’s almost a 14% increase in business ownership attributed to turning 65 and going on Medicare. It would seem that there are substantial gains to be had in moving away from the employer-based health insurance system. Is there really any good argument for retaining it?