Allison Dorneo (@allidorneo) is a Health Services Research PhD student at Boston University School of Public Health.

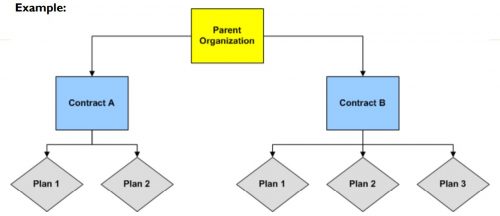

Medicare Advantage (MA) is the private insurance alternative to traditional Medicare. MA organizations contract with Centers for Medicare and Medicaid Services (CMS) to offer eligible beneficiaries residing in a defined geographic service area (a collection of counties) a selection of private plans. Insurers may offer multiple plans across different plan types under one contract. The service area is defined at the contract-level, and for most MA plans, service areas can include a single county or a collection of multiple counties. (There are other types of plans for which there are constraints on the boundaries of the service area, but these don’t account for very much of MA enrollment.)

As MA-offering insurers contract with CMS, they establish networks that govern patient liability for seeing in- and out-of-network providers. Consequently, plans will vary in their cost-sharing structures and benefit designs as they assume different levels of liability for the cost of out-of-network providers. Overall, plans will cover the cost of care (less copays and deductibles) for patients seeing providers in-network, and certain plan types may require that patients pay more for out-of-network services or receive referrals/prior authorization from primary care providers (PCP) to see specialists.

The most common plan types offered by MA insurers include the following:

- Preferred Provider Organizations (PPOs) are considered the most flexible type of plan in providing access to care and covering it out-of-network. PPO enrollees can use out-of-network providers for covered services without a referral from a PCP, albeit at greater cost to them than in-network providers.

- Health Maintenance Organizations (HMOs), in comparison to PPOs, are more restrictive plans that provide less access to care and less coverage for out-of-network providers, with the exception of emergency, urgent, and dialysis care. HMO members are required to select a PCP and must get authorization for most specialty services. For any out-of-network services received, the patient bears the full cost, up to the traditional Medicare rate.

- Health Maintenance Organization Point-of- Service (HMO-POS) are a hybrid plan between PPOs and HMOs. Like an HMO, members must select a PCP for care coordination, but they do not need a referral for specialty services. (However, some services may require prior authorization for coverage.) Like a PPO, this plan does provide some coverage for out-of-network providers.

The differences across plan types in access to and cost sharing for out-of-network providers leads to the important question, do MA networks vary by plan within contract? For example, in Figure 1 below, do the beneficiaries enrolled in Plan 1 or 2 under Contract A have the same set of in- and out-of-network providers (likewise for the beneficiaries in Plans 1-3 under contract B)? More specifically, what if Plan 1 is an HMO and Plan 2 is a HMO-POS plan, do they share the same network?

The simple answer seems to be: not necessarily, though more recent regulations attempt to push insurers toward having the same networks across plans within contracts.

For instance, prior to 2019, CMS only reviewed the adequacy of an MA organization’s contracted network under a “triggering event,” like if an organization were to operate a new plan, expand coverage to additional service areas, or in a response to inadequate network complaints. The scope of CMS’ review varied depending on the triggering event that occurred. In some cases, CMS could only conduct partial reviews of a contract’s network, looking at a select set of specialties or counties. A study by the US Government Accountability Office found that between 2013 and 2015, CMS had reviewed less than 1% of all networks. Without regular scrutiny by regulators, it seems likely that networks varied across plans within contracts.

Under the current MA Network Adequacy Criteria Guidance, CMS assesses network adequacy requirements both under triggering events (as explained above) and, separate from that, on a triennial-basis at the contract-level. CMS has previously commented in the 2021 Final Rule that this approach allows them to assess the adequacy of organizations’ networks across all of their plan types (HMOs, PPOs, SNPs) and consider the broadest availability of providers and facilities for an organization. Again, this suggests that insurers may vary networks across plans within contracts.

There are at least two scenarios for which we know certain plans can and likely do have different networks compared with other plans in the contract.

- Special Needs Plans (SNPs) are plans designed for individuals with specific diseases or characteristics, such as those who are dual-eligible, have institutional care needs, or have a chronic condition. SNPs can be allowed by regulators to augment the contract’s network to integrate care management teams and specialty providers to accommodate beneficiaries’ complex care needs under the plan’s Model of Care. While SNPs may be granted additional flexibility to alter the contract-level networks established, CMS does not allow SNPs to narrow or shrink that network. They can only expand it.

- Provider Specific Plan (PSPs) are plans often found under large, integrated medical groups or provider groups that are the primary bearers of risk. PSP enrollees have access to a smaller subset of in-network providers. Since this plan type has a network of fewer providers than the overall contracted network, organizations must request to offer a PSP from CMS and attest that these plans are in compliance with network adequacy requirements.

Future work with Vericred provider-network data could be one approach to exploring variations in networks among plans under the same contract and service area, beyond the cases listed above. If networks are varying across HMO, PPO, and HMO-POS plans within contracts, it would be interesting to explore just how different they are from one another. Moreover, as CMS reviews continues to review network adequacy requirements at the contract-level (and if networks do differ by plan), one should consider the breadth of the network that organizations are submitting for evaluation. To what extent all plans in a contract are in compliance with network adequacy rules warrants future investigation.

Research for this piece was supported by Arnold Ventures.