From an ungated EBRI Fast Facts PDF:

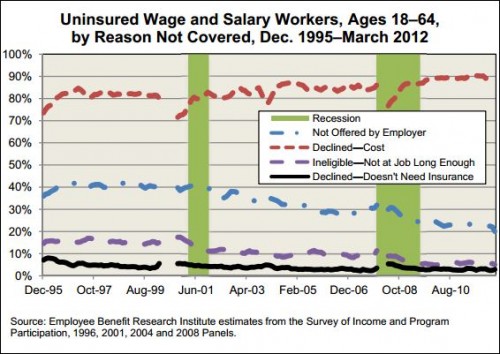

This chart is particularly interesting in light of news that the Administration is considering extending subsidies to Taft-Hartley plans, which already benefit from the preferential tax treatment of employer-based health insurance. Without passing judgement on the legality, wisdom, or justice of such a move, it would clearly make such plans more affordable. And, per the chart above, affordability of employer-sponsored plans is a significant issue, their tax exclusion notwithstanding.

More from Avik Roy:

The issue at hand is the way Obamacare affects multi-employer health plans, also known as Taft-Hartley plans. These plans consist of employer-sponsored health insurance that is arranged between a labor union in a particular industry, such as restaurants, and small employers in that sector. Approximately 20 million workers in the United States are covered under such arrangements, including 800,000 of the 1.3 million members of the United Food and Commercial Workers International Union, whose leader, Joseph Hansen, signed the letter I described above.

Workers with employer-sponsored coverage don’t qualify for subsidized coverage on Obamacare’s insurance exchanges. Those subsidies are designed for low-income people who aren’t offered coverage from the employers, and have to shop for insurance on their own. But the labor union leaders want those subsidies to also apply to their members with employer-sponsored coverage, even though they already get those benefits tax-free due to the employer tax exclusion for health insurance.