In the Journal of Health Politics, Policy and Law, Kip Sullivan of the Minnesota chapter of Physicians for a National Health Program thinks almost everyone doesn’t understand Medicare’s administrative costs. He has problems of varying degree with the writing of Greg Mankiw, Paul Krugman, John Goodman, Thomas Saving, Dianne Archer, the Kaiser Family Foundation, and Ezra Klein, whom he quotes at length and then responds,

If by “premium collection” Klein meant taxes, he was wrong; a portion of IRS costs are allocated to Medicare’s overhead by OACT [CMS’s Office of the Actuary]. If by “premium collection” Klein meant Part B premiums, he was wrong on two counts: (1) the Social Security Administration, not the IRS, calculates and collects Part B premiums for the vast majority of Medicare enrollees, and the Railroad Retirement Board does so for former railroad workers; and (2) a portion of the SSA’s and the railroad board’s costs are allocated to Medicare’s overhead by OACT. Klein’s statement that the cost of processing claims for the traditional Medicare program does not appear in Medicare’s administrative expenditures is also incorrect. OACT does include the cost of claims processing, which is done by what used to be called “carriers” and “intermediaries” and are now called “Medicare administrative contractors.” […]

The federal agencies for which Treasury collects expenditure data, and which are therefore included in the trustees’ reports on Medicare administrative spending, include the Treasury Department, the IRS, the SSA, CMS, the Department of Health and Human Services, the Medicare Payment Advisory Commission, the Area Agency on Aging, the Department of Justice, the Federal Bureau of Investigation, and the Railroad Retirement Board (see the appendix). In addition, the appendix lists “quality improvement organizations,” which are private-sector organizations with which CMS contracts. The appendix also indicates that payments by CMS to insurance companies that process claims for Medicare’s original fee-for- service program are included in the trustees’ definition, as are the cost of buildings that house CMS staff and the cost of the numerous demonstration projects Congress requires CMS to conduct.

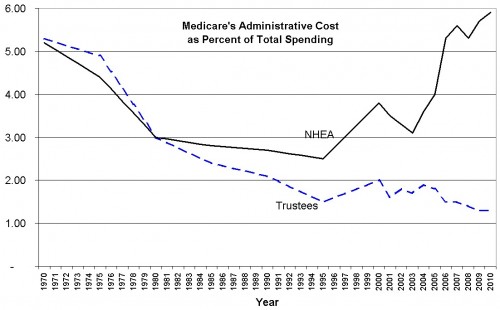

According to Sullivan, the Treasury’s calculation of administrative costs does not include those incurred by Medicare Advantage and private, Part D (drug) plans. Those are, however, included in the administrative costs calculated for the National Health Expenditure Accounts (NHEA). Examining the two flavors of administrative costs is instructive. I’ve graphed the figures Sullivan includes in his Table 1, below.

The trustees’ and NHEA measures were fairly close until the 1980s. Then they diverged as enrollment grew in Medicare Advantage and its predecessor programs. In 2006, Part D drug plans became available and the two types of administrative costs diverged further still. As traditional Medicare’s administrative costs went down, those of private plans grew.

Sullivan writes,

This enormous disparity between two measures that used to be almost identical should long ago have triggered inquiries within Congress and the US health policy community as to whether the higher administrative costs associated with the growing privatization of Medicare are justified.