I’m reading David Goldhill’s Catastrophic Care: How American Health Care Killed My Father–and How We Can Fix It. All posts are tagged with Catastrophic Care. This one is about the first chapter.

I began reading the book in a rather grumpy mood. I’m feeling a bit less grumpy, but not enough to prevent myself from griping about the length of Chapter 1. That it seemed long is my problem, not Goldhill’s. I’ve just seen all the arguments before, so it was tedious to read them again. But, if you haven’t heard the set up for the case for a smaller role for government and insurers in health care, by all means read it.

It includes the standard example of LASIK surgery.

It is seldom covered by insurance and exists in the competitive economy more typical of [other goods and services]. So people who get LASIK surgery—or, for that matter, most cosmetic surgeries, dental procedures, or other typically uninsured treatments—act like consumers. If you do an Internet search, you can find LASIK procedures quoted as low as $299 per eye—a price decline of roughly 90 percent since the procedure was first commercialized in the early 1990s. You’ll also find sites where doctors advertise their own higher-priced surgeries (which usually cost about $1,500 per eye) and warn of the dangers of discount LASIK. Many ads publicize the quality of equipment being used, as well as the performance record of the doctor, in addition to price. In other words, from day one we’ve had an active, competitive market for LASIK surgery of the sort we’re used to seeing for other goods and services.

Here’s where you’d expect me to point out why the LASIK case doesn’t generalize, the standard counterargument. It’s a fine argument, but I’m not going to make it. Instead, let’s talk about how LASIK does generalize. I’ve actually been thinking about this (again) lately, even before reading Catastrophic Care. So, this is a good opportunity to reveal my not-fully-developed thoughts.

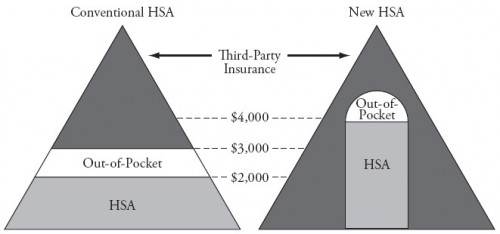

LASIK is an elective procedure, the purpose of which is well understood by the patient. I’m on board with the idea that insurance shouldn’t cover such things, or if it does, not the full cost and certainly not the marginal cost. All health procedures just like this are good candidates for the purview of John Goodman’s “New HSA.”

Now, let’s push the boundary. Let’s think of some things that are not exactly like LASIK. Here are some easy ones: trauma care, repair of a broken bone, insulin. I think one can make a case that insurance should cover those, either because their need is urgent and not predictable and/or because they are cost-effective in some sense. The cost liability for these can reasonably be assigned to third-party insurance.

What about an MRI scan? Is it elective? Is the purpose always clear? Is it urgent or not? What about an angioplasty? How about an antibiotic for a sinus or ear infection? Or a routine health check with various cancer screenings (prostate for men, breast for women, say)? Are these like LASIK or not?

I admit I can twist myself in knots on some of these, though not all. What about you? What makes something elective? Does it have to be life saving to be non-elective? What makes its purpose clear to the patient? Does the patient need to understand all the risks and alternatives?