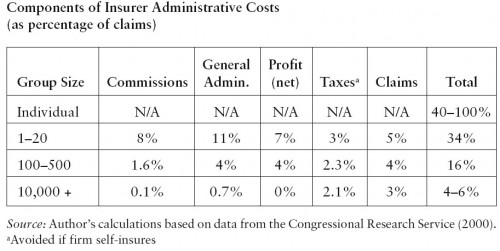

I’m reading Mark Pauly’s Health Reform without Side Effects (ungated). Here are a few useful tidbits I’ve encountered so far about insurer profits and other administrative costs.

The time trend in the loading percentage [the “Total” column above] has been modestly upward across the board; the average loading in private insurance has probably increased by 1 to 1.5% of premiums over the last 20 years. This is largely due to the spread of managed care, which is somewhat more costly to administer (per dollar of benefits or premium) than was old-style insurance, which just paid claims but did not select panels of providers, preapprove coverage, or attempt to manage care.

It’s worth keeping in mind that managed care may reduce spending by negotiating lower prices and imposing some checks and controls on utilization, but that does not come without costs.

There is, however, more competition among insurers than simple market-share measures would suggest. For one thing, most large groups self-insure, purchasing administrative services only (or some reinsurance) from the private insurers. These large buyers would not tolerate prices (for coverage or administrative services) that yield high insurer profits because they can turn both to administrative-services-only firms (such as benefits consultants) and plans in other states to provide those services. Smaller employers and individuals are more vulnerable. Even here, however, there is potential entry into the pure insurance business should any existing insurer try to exercise serious market power.

It’s an interesting rebuttal to the claim that high insurance market power is to blame for high and increasing health care costs. Given the results of the table above, which suggests relatively modest profits (circa year 2000), there likely are sources of competition generally overlooked.

Still, one should not be terribly happy about the high loadings for small group and individual market products. If, by rearrangement, we can avoid those costs, we ought to.