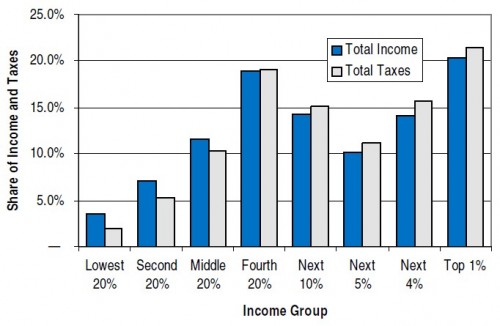

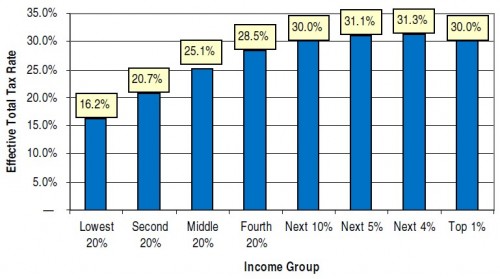

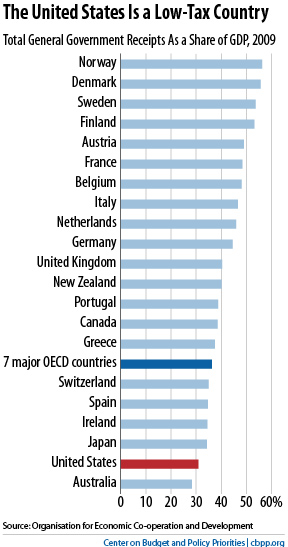

I find that charts like these provide helpful perspective. The first two are from Citizens for Tax Justice. The last one is from the Center on Budget and Policy Priorities. Both sources provide much more in this area. Figures account for taxes and revenue at the federal, state, and local levels (including payroll, income, excise, estate, and property taxes).

Bottom line: US taxes are low by international standards. They’re also not that progressive, particularly in the top half of the income distribution. They’re not progressive at all in the top 10% of the income distribution.