Lily Batchelder, Fred Goldberg, and Peter Orszag wrote,

Currently the vast majority of tax incentives operate through deductions or exclusions, which link the size of the tax preference to a household’s marginal tax bracket. Higher-income taxpayers, who are in higher marginal tax brackets, thus receive larger incentives than lower-income taxpayers. This Article argues that providing a larger incentive to higher-income households is economically inefficient unless policymakers have specific knowledge that such households are more responsive to the incentive or that their engaging in the behavior generates larger social benefits. Absent such empirical evidence, all households should face the same set of incentives.

Discussing our Hamilton Project paper, Orszag brought this point up with respect to the employer-sponsored health insurance tax exclusion. It’s hard to make an efficiency argument for the regressivity of that exclusion, and it’s tempting to raise its inefficiency as justification for the Cadillac tax …

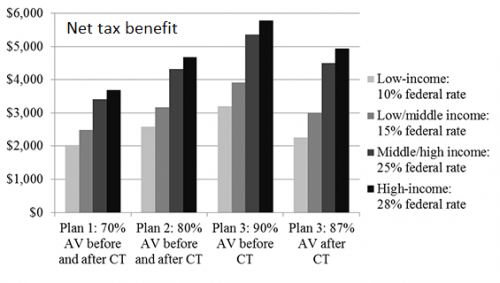

… except it barely addresses regressivity. This is shown by Bradley Herring and Erin Trish:

See our paper for other approaches.