Every year, the Kaiser Family Foundation publishes its annual survey of Employer Health Benefits. Here’s the summary. Here’s the chart pack. Let’s wade right in.

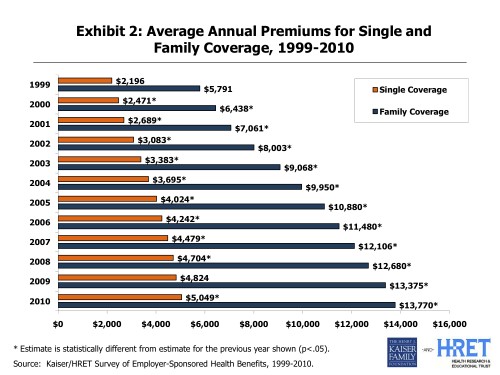

The average premium for coverage by an employer provided health insurance plan for an individual in 2010 is $421 per month or $5,049 per year. The average premium for family coverage is $1,147 per month or $13,770 per year. Think about that for a second. That’s not the Cadillac plan. That’s the average. Twenty percent of plans for families cost $16,524 or more. How has that changed over time?

Health care premiums have more than doubled in the last decade. Has your salary more than doubled in the last decade? I doubt it. We are putting more and more or our income every year into health insurance premiums. Do you feel healthier? Do you feel safer? Do you feel happier?

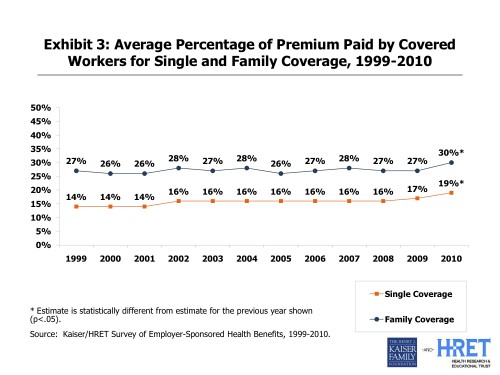

This doesn’t mean that employers are paying all of the premiums, though. How much of those premiums are workers paying for themselves our of their own income?

This year was an all time high. What you have to remember is that this means that not only are the premiums going up; so are the percentages of those premiums that individuals and families have to pay. So their costs are going up even faster than premiums are. In fact, this year was the first statistically significant increase in the percentage of premium paid by employees in a decade.

Economists will say–and they have the studies to back it up–that employees actually pay the full cost of premiums (including the “employer” share) in the form of slower wage growth. Nevertheless, few workers understand this. The perception is that only the employee share is paid by workers. But that’s gone up too, so perception and truth align. Employees are paying more.

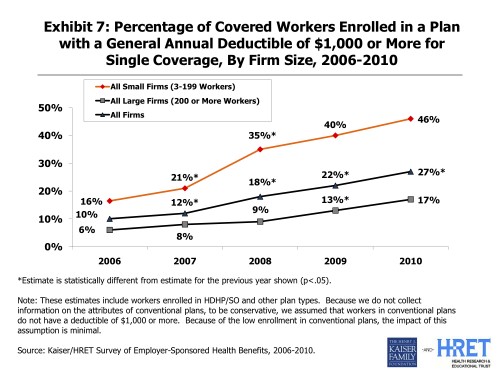

But remember, that’s just the premium. It doesn’t include cost-sharing – things like co-pays, out of pocket costs, or deductibles. So how much are deductibles?

What this means it that even after paying for an increasing percentage of an all time high premium, more than one in four workers in an individual plan still has an annual deductible of $1000 or more. That’s a lot.

What this means it that even after paying for an increasing percentage of an all time high premium, more than one in four workers in an individual plan still has an annual deductible of $1000 or more. That’s a lot.

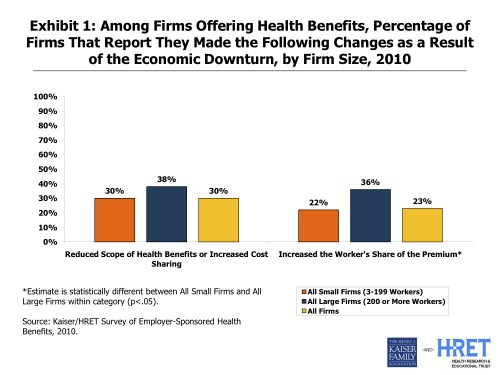

How did the recession affect employer health benefits? Well, if companies need to trim their budgets they can either reduce the quality of coverage, or they can make employees pick up a bigger share of the cost. How often did this occur?

So looking at the yellow bars, which represent all firms, 30% of them reduced the benefits of the insurance offered or increased the amount of cost sharing for their employees (either in co-pays or deductibles). Another 23% reduced the share of the premiums that they paid, making their employees pay more. Again, remember this is at the same time that premiums went up.

So looking at the yellow bars, which represent all firms, 30% of them reduced the benefits of the insurance offered or increased the amount of cost sharing for their employees (either in co-pays or deductibles). Another 23% reduced the share of the premiums that they paid, making their employees pay more. Again, remember this is at the same time that premiums went up.

So, benefits reduced. Cost-sharing increased. Share of premiums paid increased. Total premium cost at an all time high. And this is for employer provided health benefits, which are usually much better and cheaper than what’s available in the individual market. Depressed yet?

I know that PPACA has barely kicked in yet. Just as you can’t blame PPACA for the current bad situation, you can’t fault PPACA for not fixing it yet. But everyone who thought that health care reform would become more popular after it was passed better take a close look at this. Things are getting worse, and not slowly; there’s no reason to think that it’s not going to continue. And since the majority of reforms don’t kick in until 2014, we still have time to continue in free fall. Moreover, the idea that we would leave the employer-based health care system – which is what this survey measured – alone, may have sounded like a good talking point, but I’m not sure how popular it will be if these trends continue.

PPACA has it’s work cut out for itself. I hope it’s up to the task.