There’s another message of the Health Affairs paper Aaron wrote about earlier. It comes from asking this question: putting aside whether you think high deductible health plans (HDHPs) are good or bad, do you think they’re a sustainable solution?

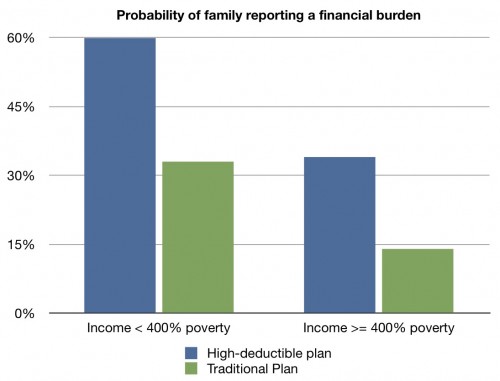

Look again at the graph Aaron presented:

How do you think people who report a financial burden feel about their health plan? I think it is not a stretch that they are vastly more likely to feel that it is letting them down. In other words, even if HDHPs are (or could be, or will be) doing a tremendously good job of keeping health care spending and premiums down, even if they don’t do so with any sacrifice in health outcomes (all debatable points), people may come to hate them.

Is “hate” too strong a word? No, it is not. Ask an average American how she felt about her health plan in circa 1997 and I think “hate” (or similar) would enter the conversation. Back then, managed care was “solving” our health spending problems. It wasn’t the type of solution Americans were willing to tolerate. So, gone are the days of very tight networks and utilization controls. (They still exist. They’re just not as onerous.)

I don’t hope that HDHPs experience the same fate. I have no big stake in whether they work or not. My point is that when you look at something like the figure above it is hard to imagine Americans are going to embrace them long term.

For a time HDHPs may “work” (or seem to). But keep your helmet and pads on. The backlash may be strong.