Debate over Alan Simpson’s comments on life expectancy continues.

The last chart from my previous post on this topic showed differences in life expectancy by race. What you’d really like, however, is differences by socioeconomic status. After all, it’s far more likely that we can (and perhaps should) base policies on earnings rather than race. Unfortunately, the CDC data I used two days ago didn’t have differences by earnings.

But then I received an email from Paul Van de Water, pointing me to a paper by Hilary Waldron that appeared in Social Security Bulletin in 2007. It’s entitled, “Trends in Mortality Differentials and Life Expectancy for Male Social Security–Covered Workers, by Socioeconomic Status.” She did the work for me.

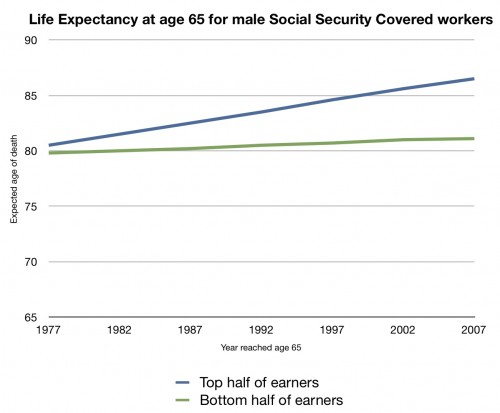

Let’s start with a chart I made from her paper (Table 4):

What you’re looking at is the life expectancy of a male who reached age 65 in 1977-2007. The blue line is the top 50% of earners; the green line is the bottom 50%. While the top half of earners have seen an increase of their life expectancy at 65 rise about 5 years over these three decades, the bottom half saw their life expectancy at 65 rise barely a year.

Think about that when advocating for an increase in the age of eligibility because “everyone” has seen their life expectancy increase.

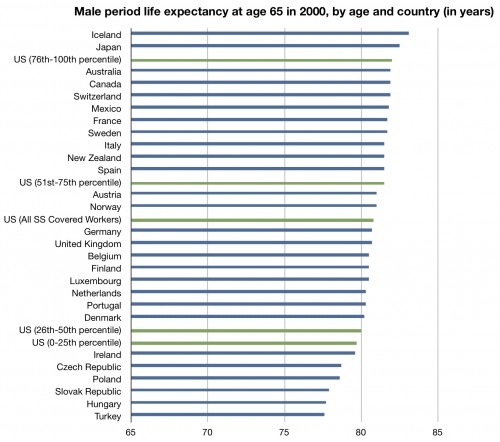

Here’s another chart I made from Hilary Waldren’s data (Table 9) comparing the life expectancy at age 65 for Social Security-covered male workers in four different earning percentile brackets in the US and other OECD countries:

While the richest 25% of Americans compare favorably to any other country, those in the bottom 50% of earners don’t. In fact, half our country can expect to live shorter lives from age 65 than the average person in almost all of these countries.

Think about that when arguing that the richest country in the world can’t afford Social Security and Medicare starting at age 65 because “everyone” in this country has seen their life expectancy increase.

Update: Added in US Total for All Social Security Covered workers. Note that this does not include American males who are not covered by Social Security.