Look for more developed pieces from me on drug shortages, forthcoming. Here are some notes that will inform them.

Health Affairs Health Policy Brief (2014):

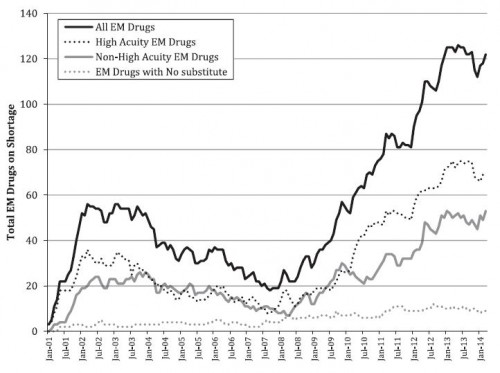

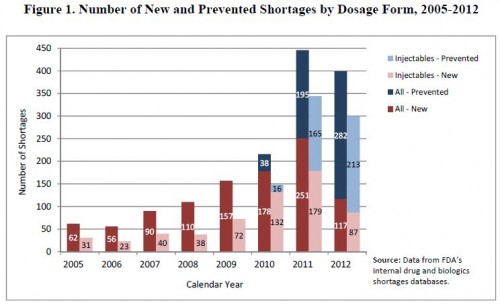

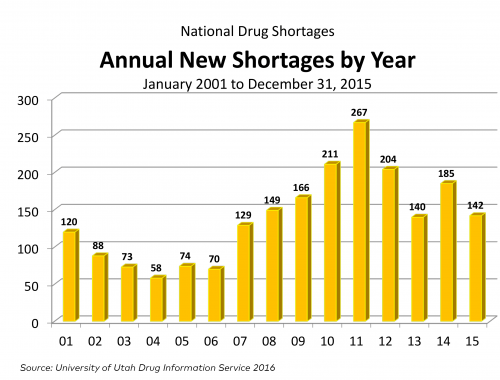

- The number of drug shortages tripled between 2005 and 2010 (Wilson 2012, from which more below).

- More recently, the incidence of new shortages has fallen, but the total number of drugs in shortage has continued to grow.

- The most severely affected drugs were generic injectables, including those for cancer, infectious diseases, or used during surgeries.

- Generic injectables are most prone to shortages because of a low number of capable manufacturers leading to low capacity.

- Drug shortages are most problematic for patients in cases for which there are no good substitutes.

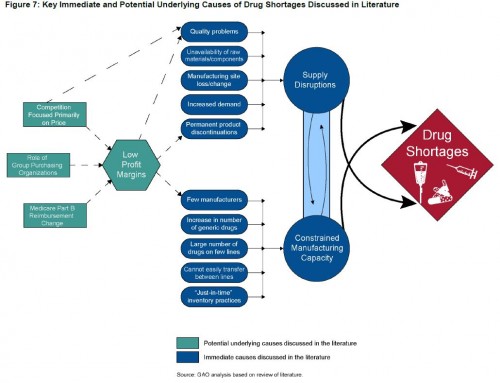

- A variety of factors contribute to drug shortages: manufacturing problems and disruptions (e.g., due to to quality problems that require ceasing a plant’s operations), delays in FDA approvals, demand spikes (e.g., when an old drug is found to be applicable to a new condition), reduced profits when drugs achieve generic status, lower Medicare Part B reimbursement that began in 2003 that incentivize switching to higher cost drugs and reduce investment in generics.

- Shortages of generic injectables are less common in Europe, perhaps because generic drug prices are higher there than in the US.

- There have been calls to pay more for drugs prone to shortages, which would increase investment in manufacturing capacity.

Health Affairs Blog (2015):

- Drug shortages can harm patients by forcing them to switch to less effective/higher risk therapies or delay care.

- Manufacturers are required to notify the FDA of anticipated manufacturing disruptions. Working with industry, the FDA helped prevent 80 percent of anticipated shortages in 2013 (FDA’s drug shortage strategic plan, from which more below).

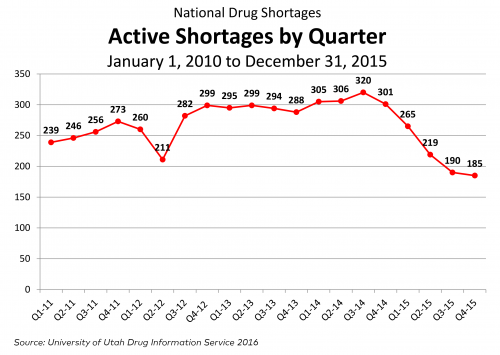

- Both the FDA and the University of Utah Drug Information Service (UUDIS) have measured declines in drug shortages since 2011.

- The FDA and UUDIS measure shortages differently.

- The FDA measures market-wide shortages, based on the combined supply of a drug from all manufacturers. If a supply shortage from one can be made up from another, there is no shortage, according to the agency. An FDA-defined shortage is clearly problematic for anyone seeking or needing the drug in short supply.

- UUDIS tracks manufacturer-specific shortages, regardless of whether another manufacturer of the same drug has additional, offsetting capacity. A UUDIS-defined shortage may be problematic form some patients and clinicians if switching source introduces room for error (e.g., different sources supply different unit doses) or causes delays.

Wilson, Health Affairs (2012):

- 75% of drugs with shortages are sterile injectables and mostly low-cost generics.

- These drugs are not very profitable. If they were, supplies would not dry up so easily.

- In addition to Part B payment changes (mentioned above), group purchasing organizations (GPO) with large buying clout push prices for these drugs lower.

- Most shortages are due to manufacturer quality problems or manufacturing delays. Both issues can be explained by low profit margins, which disincentivize maintenance of adequate manufacturing capacity.

- Market forces (low profits, volume purchases) have concentrated manufacturing into a small number of companies, further reducing capacity redundancy. Just three companies sell 71 percent of sterile injectables.

- “Among the drugs in short supply are generic injectable drugs, including many used to fight cancer; antibiotics and other antiinfection drugs, including some used to treat tuberculosis, syphilis, and some forms of herpes; anesthetics for use in surgery, including sodium thiopental (which the World Health Organization considers a core medicine for a basic health care system); and medications to repair electrolyte imbalances in the body caused by vomiting and diarrhea, excessive heat, or severe illness.”

- “[T]wo fatal events were reported involving doctors prescribing doses of hydromorphone ‘as if it were morphine,’ even though it’s seven times as powerful as morphine, which was in short supply. […] [S]ome people have awakened during surgery because anesthesiologists were not as familiar with the alternative agents they had to use.”

- Drug “scalpers” arise during shortages — shady organizations with no oversight that have stockpiled drugs prone to supply disruptions that turn around and sell them at extreme markups.

Hawley et al., Academic Emergency Medicine (2015):

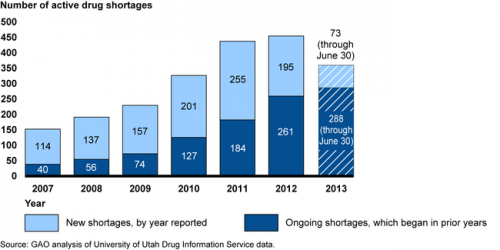

- According to a GAO report (from which, more below) the number of FDA-defined active drug shortages (as distinct from incident drug shortages) nearly tripled between 2007 (when there were 154) and 2012 (when there were 456 ). The GAO put the blame on drug market economics, including low profit margins for generic, injectable drugs.

- Low profits can contribute to quality problems. Just over half of drugs in shortage in 2012 were made at facilities undergoing FDA remediation.

- “A wide range of medications used both in the emergency department (ED) and in prehospital settings, such as antidotes, heparin, and nitroglycerin, have recently been affected by national drug shortages. Not having commonly used medications to treat high-acuity conditions such as respiratory distress, cardiac dysrhythmias, and overdoses can reduce the ability of ED providers to deliver quality care because in many cases substitutes are considerably less effective, and physicians are not as familiar with their use.”

- What follows, from Hawley et al., is based on UUDIS (not FDA) shortage data.

- One-third of the nearly 2,000 drug shortages between 2001 and 2014 were for drugs used in emergency medicine (EM). Half of those EM drugs are for life-threatening conditions. Ten percent of those lacked substitutes. Median shortage time for all EM drugs in shortage was 9 months.

- Reasons for almost half of the EM drug shortages were unknown. Among those for which the reason was known, half were due to manufacturing issues.

- Manufacturers may divert resources to more profitable products, contributing to shortages for generic injectables (via an ASPE Issue Brief, from which more below).

GAO (2014):

- The GAO pins blame for drug shortages on low profit margins that constrain investment in manufacturing capacity and quality.

- When the FDA becomes aware of an impending shortage, it can take several steps. For example, it can provide assistance to resolve manufacturing problems, expedite inspections to speed the marketing of substitute products or return halted facilities to production, permit temporary importation of substitute products, speed drug approvals.

- The FDA can also determine that closing a facility with a quality problem may do more harm than good if the drugs that would produce a shortage of necessary drugs.

- The FDA cannot compel manufacturers to increase production. Nor does it have the authority to increase the prices public or private entities pay for drugs.

- Over half of drugs in shortage since 2007 have been in shortage more than once. Between 2007 and the middle of 2013, average shortage duration was slightly less than a year.

- “Four therapeutic classes—anti-infective, anesthetic and central nervous system, cardiovascular, and nutritive—comprised 53 percent of critical drug shortages.”

- Consequences of shortages for patients include delays in care, side effects from alternatives, and medication errors in drug switches.

- “One study found that most generic sterile injectable drugs are made by three or fewer manufacturers. […] Two studies [only one of which is online] noted that older generic drugs may be discontinued in favor of producing newer drugs that are more profitable or that have more demand.”

- “Low profit margins in the generic market may affect manufacturers’ decisions to invest in their facilities.”

- “Studies assert[] that GPOs reduce profits in the generic drug market, where margins are already low. […] [B]ecause of these low manufacturer profit margins, when production problems arise, manufacturers may stop producing certain products in lieu of making investments in improvements at their establishments.”

- Yearn for an update of the chart above? Later in this post, I’ve got some more recent numbers. The figure below documents GAO’s conclusion that low profits are the underlying cause of shortages.

FDA’s Strategic Plan for Preventing and Mitigating Drug Shortages (2013):

- The FDA can help prevent or mitigate a drug shortage by finding other manufacturers who may be able to increase production, expedite inspections and drug approvals, take manufacturing/supply capacity into account when making enforcement decisions, work with manufacturers to find the root cause.

- FDA has “limited” ability to offer financial or other economic incentives to promote high-quality manufacturing. It suggests payers might explore these to “encourage high-quality manufacturing that could help reduce the occurrence and severity of shortages.”

- The following is from an FDA drug shortage infographic and it adds a couple of years to the chart just above. Be careful comparing these charts with the one from the GAO, above. As I mentioned, the FDA and UUDIS (whose data on which GAO’s analysis relies) define a shortage differently.

ASPE Issue Brief (2011):

- Shortages are exacerbated by a recent, rapid increase in the scope and volume of drug products, with no commensurate expansion of manufacturing capacity. The increase in products stems from an increase in chemo drugs and patent expiration. In other words, injectable manufacturers have a much wider range of drugs they could make, crowding out lower-profit ones (in the context of capacity that cannot expand rapidly enough).

Ridley et al., Health Affairs (2016):

- This is about vaccine shortages and vaccine pricing. I’ve already written a forthcoming post about it, so I’m not going into it here.

Engelberg et al., Health Affairs Blog (2016):

- For some older, generic drugs with few suppliers, prices have gone way up. In a well-functioning market, that would normally draw market entry, increase competition, and push prices back down.

- This does not happen with some drugs because of barriers to entry (e.g., controlling drug distribution so other companies can’t obtain enough to conduct testing required to produce a generic competitor).

- The FDA approval process also serves as a barrier to timely entry. This could be sped up by, for example, allowing data submitted to other countries’ drug regulators to suffice for FDA approval purposes.

Now, for some updated figures, courtesy of Doug Zurawski, which show that new shortages are down, as are active shortages (UUDIS data).

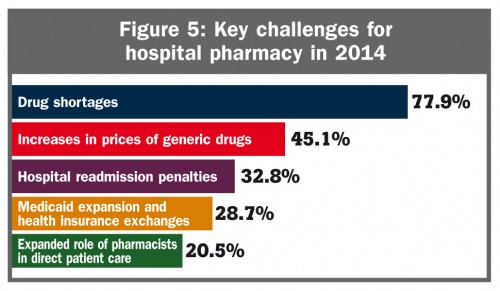

And, finally, shortages are the most significant issue to hospital pharmacists, according to one survey: