This is an ongoing series on health care system “memes” that continue to permeate our debate, even when evidence shows them to be false. The introductory post contains links to all entries.

I’ve done this one before; it even won chart of the year from Andrew Sullivan’s Daily Dish last year. But I still get emails and comments asking me to tackle it. Evidently, it still needs busting. Too many still repeat the well used meme in the health care debate that people in other countries – frustrated by wait times and rationing – come to the United States for care. These are almost always anecdotal stories and you should know by now how much stock I put in anecdotes.

As always, when we can we should turn to evidence and research, and on this topic it does exist. The most comprehensive work I’ve seen on this topic was published in a manuscript in the peer-reviewed journal Health Affairs. That study looked at how Canadians cross the border for care. Most anecdotes involve Canadians, since it’s easy for those on the border to come here. And, the authors used a number of different methods to try and answer the question:

1) First, they surveyed United States border facilities in Michigan, New York, and Washington. It makes sense that Canadians crossing the border for care would favor sites close by, right? It turns out that about 80% of such facilities saw fewer than one Canadian per month. About 40% saw none in the prior year. And when looking at the reasons for visits, more than 80% were emergencies or urgent visits (ie tourists who had to go to the ER). Only about 19% of those already few visits were for elective purposes.

2) Next, they surveyed “America’s Best Hospitals”, because if Canadians were going to travel for care, they would be more likely to go to the most well-known and highest quality facilities, right? Only one of the surveyed hospitals saw more than 60 Canadians in one year. And, again, that included both emergencies and elective care.

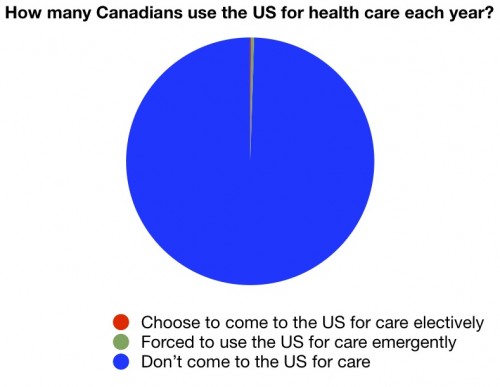

3) Finally, they examined data from the 18,000 Canadians who participated in the National Population Health Survey. In the previous year, only 90 of those 18,000 Canadians had received care in the United States; only 20 of them had done so electively.

Here’s another way to look at that final statement:

Look, I’m not denying that some people with means might come to the United States for care. If I needed a heart/lung transplant, there’s no place I’d rather be. But for the vast, vast majority of people, that’s not happening. You shouldn’t use the anecdote to describe things at a population level. This study showed you three different methodologies, all with solid rationales behind them, all showing that this meme is mostly apocryphal.

Maybe that’s why the manuscript was titled, “Phantoms in the Snow.”