I got a tweet this morning from Paul Cohen, who posted this analysis on his blog yesterday. It’s not peer reviewed or anything, but he posted the code for his work, and it’s the kind of simple analysis we’d throw up here with caveats, so take all of this with the appropriate sized grain of salt.

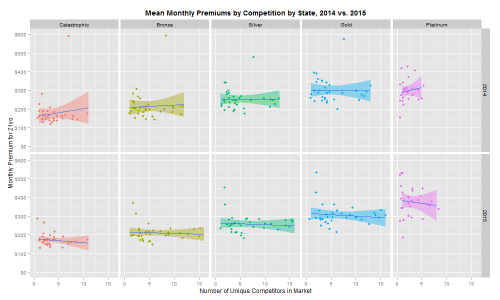

First, he plotted the mean monthly premium in each state by the number of insurers in the state. Then he did a linear regression. If you believe competition lowers premiums, then you’d hope to see a decline with more insurers. You don’t:

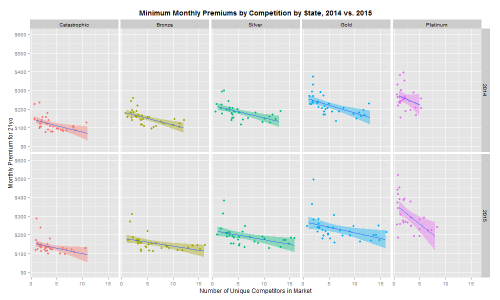

Then he performed the same analysis, but looked at the minimum premium instead of the mean:

That showed a statistically significant relationship. He found that for each additional insurer, there was a 3% reduction in the amount of the minimum monthly premium.

A few things to note here. This isn’t controlled for a gazillion things, and I can already hear many of you howling. So be it. But this strikes me as plausible. I think that premium costs are likely being lowered by narrowing networks and making deals, and that’s more likely to occur with more insurers. I don’t think that anyone is going to figure out the “secret sauce” to radically change the delivery of health care in such a way as to reduce actual health care spending, or make people healthier. At least, I don’t think that will occur in such a way that more competition will lead to changes.

It’s likely that more competition means that someone is able to offer a product that’s more bare-bones that some will like. It likely doesn’t mean that they’re innovating to drive down overall spending.

Anyway, it’s worth considering; when I see a blog doing this kind of work, it’s worth highlighting. So go read.