Democrats seem to believe that most Americans want to preserve the 20th-century welfare state programs. But they are unwilling to ask voters to pay for them, and they are unwilling to describe the tax increases that would be required to cover their exploding future costs.

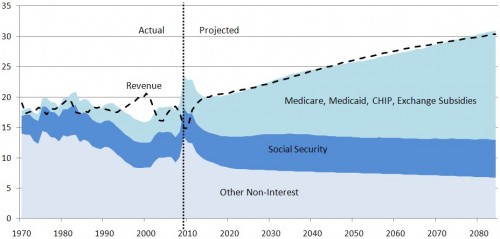

The CBO’s baseline projection* of the federal primary budget as a percent of GDP after passage of health reform:

Maybe Democrats have not successfully communicated that the intention and scored prediction of the law is to fully balance the budget as far as the eye can see and to do so with tax increases. I’ll grant that. Maybe we don’t believe future Congresses will allow tax revenue to grow as large as depicted in order to cover the government’s costs. I’ll grant that too.

But I do recall quite a vociferous debate over just this issue. Did Americans fail to notice that the health reform law spends a lot of money and includes a lot of tax increases? If so, that’s not just a Democratic messaging problem, but a Republican one too, and a general media failure. What more would it take to communicate this?

That being said, it certainly appears as if the intention of last year’s Democratically controlled Congress was to balance the books, at least insofar as the primary budget is concerned. (The primary budget excludes interest on the debt, which is large. If you don’t like the graph in that link, here’s another.)

We can do better in communication and in policy. But we cannot ignore the expected revenue in the ACA. Where does that revenue come from? Taxes and fees. I’m not saying anyone has to like that or support it. I’m saying it’s what’s in the law. And CBO agrees.

* For their other projection — the alternative fiscal scenario — see these many posts.

UPDATE: Added link to graph with debt interest.

UPDATE 2: Added another link to a different post with a debt interest graph. Also added footnote about the alternative fiscal scenario.