The Commonwealth Fund has released a report on how health insurance premiums and deductibles have changed from 2003 to 2010. It’s somewhat frightening. It turns out that the cost of insurer based health insurance have risen three times faster than wages since the beginning of the decade:

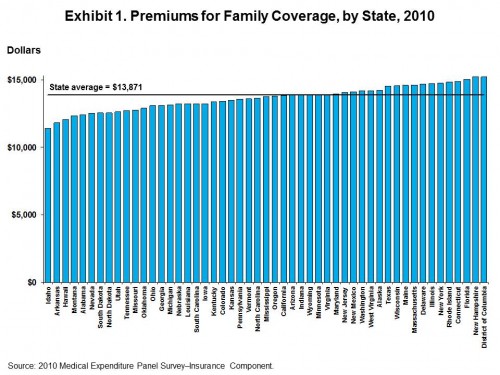

The average premium for employer-based family coverage was$13,871 in2010, with about a third of sates averaging more than $14,000 a year. Florida, New Hampshire, and the District of Columbia averaged more than$15,000 a year. Think about that. It’s a ton of money.

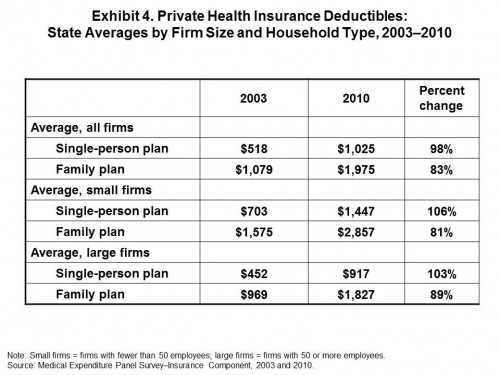

Moreover, that’s just the premiums. Deductibles have been going up, too:

Over the seven year period, deductibles increased from 83% to 106%. Did your salary go up that much? No? Neither did most people’s.

Over the seven year period, deductibles increased from 83% to 106%. Did your salary go up that much? No? Neither did most people’s.

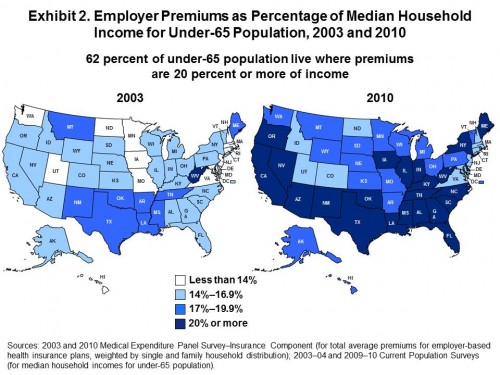

One more scary slide:

By 2010, more than 60% of people lived in areas where insurance premiums cost at least 20% of their income. And that’s just premiums; it doesn’t include deductibles, it doesn’t include co-pays, and it doesn’t include co-insurance.

This is likely unsustainable. The growth rate of insurance is far above that of wages, meaning that health care costs are going to consume a higher and higher percent of people’s incomes in the future. Moreover, this is a problem of the non-elderly. Because of Medicare, few elderly have premiums which consume this level of income.