Is the Blue Cross Blue Shield of Massachusetts “Alternative Quality Contract” the wave of the future? The most thorough explanation of it I’ve read is provided in a recent Health Affairs article by Chernew, Mechanic, Landon, and Safran. Here are some key passages, beginning with the abstract:

In January 2009 Blue Cross Blue Shield of Massachusetts launched a new payment arrangement called the Alternative Quality Contract. The contract stipulates a modified global payment (fixed payments for the care of a patient during a specified time period) arrangement. The model differs from past models of fixed payments or capitation because it explicitly connects payments to achieving quality goals and defines the rate of increase for each contract group’s budget over a five-year period, unlike typical annual contracts. All groups participating in the Alternative Quality Contract earned significant quality bonuses in the first year. This arrangement exemplifies the type of experimentation encouraged by the Affordable Care Act. […]

Eligibility for the Alternative Quality Contract requires that a group include primary care physicians who collectively care for at least 5,000 members of Blue Cross health maintenance organizations (HMOs) or point-of-service (POS) plans. […]

Blue Cross does not seek to reduce a group’s initial budget below its current spending levels. Rather, it focuses on controlling future growth rates. […]

After initial budgets are set, Blue Cross uses trend allowances to manage health care spending growth over the five-year contract period. Setting these annual budget growth rates is a critical aspect of the negotiation [between Blue Cross and providers]. […]

Prior versions of capitation were criticized for creating financial incentives for medical groups to withhold necessary care in order to save money. Blue Cross has attempted to address this criticism by creating quality incentive payments of up to 10 percent of the total per member per month payments. […]

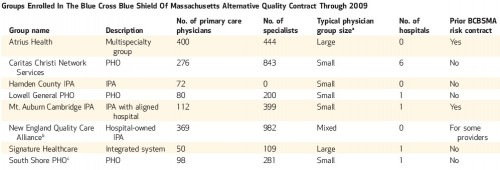

In 2009 the Alternative Quality Contract covered about 1,600 primary care physicians, representing just over one-quarter of the primary care physicians in the Blue Cross HMO and POS network, who care for about one-third of Blue Cross’s HMO and POS plan members. [See the table below (click to enlarge).]

The Alternative Quality Contract differs from the shared savings model proposed for paying Medicare accountable care organizations under the Affordable Care Act in a number of important ways. First, the Alternative Quality Contract groups bear significant financial risk for failure to meet budget targets. Medicare ACOs may not bear significant financial risk if they fail to meet budget targets.

Second, Blue Cross members can be in the Alternative Quality Contract only if they are enrolled in an HMO or POS plan in which they must select a primary care provider. […]

Third, the Alternative Quality Contract is based on negotiated payment rates and budgets.

This type of innovative contracting is very exciting to see. To what extent is it generalizable? The authors consider that question, noting that Blue Cross has substantial market power, which facilitates its ability to pressure providers into alternative contracts. On the other hand, in the Boston area, hospitals also possess considerable market power. Medicare, being immune to the market power of providers, is also able to set up contracts of this type, though a different model is under consideration, as noted above.

One thing is clear to me, increasing competition among insurers would make such contracting more difficult. That’s not to say that a monopolistic insurance market is a goal. The balance of power between insurers and providers is critical, not that anyone knows precisely how to measure it or what the optimal balance is.