I concluded yesterday’s post with a paradox. On the one hand, there is evidence that search frictions increase the rate at which individuals change plans. On the other, there is evidence that search frictions decrease switching or lead to status quo bias. How can both be true?

The answer is that status quo bias is expected when search frictions are very high or very low while increased plan turnover (switching) is expected when search frictions are at a moderate level. To understand why, it is important to recall what search frictions do. They are a source of plan market power, a means by which plans can charge premiums above marginal cost. Think of it as the power due to obfuscation that can be leveraged through marketing. This is something we all experience when confronting a complex product that we can’t fully evaluate.

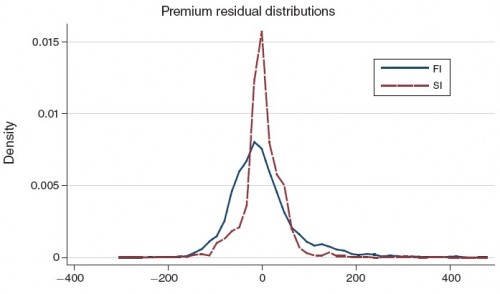

The degree to which plans can take advantage of search frictions varies, which causes a distribution in premiums, even controlling for observable plan factors. That’s what Cebul at al. showed. Click through for the explanation. Here’s the chart, again.

So, back to the paradox. How do search frictions lead to status quo bias and higher turnover. By email, Jim Rebitzer, a coauthor on the paper that provides the chart above, explains,

If search frictions are very very small, the distribution of prices collapses around marginal costs (perfect competition is a special case of the model). With very very small frictions, there would be very little incentive to change plans if there were any switching costs at all.

If search frictions are very very large, the distribution of prices collapses around the consumer’s maximum willingness to pay for insurance. In this case there would be very little turnover because: (1) there is little price dispersion; and (2) the rate of arrival of information about outside offers would be very slow. This case matches your intuition that search frictions would lead to less rather than more turnover.

What we found in health insurance markets suggests moderate search frictions. Frictions large enough to support substantial price distribution and therefore large enough to support substantial turnover incentives. It turns out that moderate frictions are enough to distort markets in significant ways.

Translation: Perfect competition requires full information and, thus, has no search frictions. Moreover, products are homogeneous. There is no need to switch. When competition is not perfect and search frictions are very high (and also, in a trivial way, under monopoly), one should not expect much, if any, plan turnover. It’s just too hard to learn anything about other products (or, under monopoly, there are no other products). Status quo bias will reign. However, in a mid-range of degree of competition and search frictions, switching can exist.

Note that the degree of search frictions can vary by market sector (employers vs. Medicare beneficiaries) and can vary by type of searcher (high vs. low cognitive ability). Thus, status quo bias might predominate in some circumstances, plan turnover in others. Hence, the disparate results in the literature are reconciled. The paradox is resolved.