This is a TIE-U post associated with Karoline Mortensen’s Introduction to Health Systems (UMD’s HLSA 601, Fall 2012). For other posts in this series, see the course intro.

Medical Care Costs: How Much Welfare Loss? by Joe Newhouse (JEP, 1992; the link is to an ungated PDF) begins as many health care economics papers do, with a description of how much health care costs: over 12 percent of the economy in 1990! If that was cause for concern over two decades ago, we now should be positively terrified. Today it is over 18 percent! Because public financing of health care is not fully offset by sufficient revenue, government debt has and will be driven upward by growing health spending. (Though, yes, in the most recent decade, debt has been largely driven by other things too.)

But, as Newhouse points out, we should not be overly concerned about such growth per se. After all, growth in spending on something might simply mean we are getting increasing value from that something relative to other uses of our wealth. We are spending vastly more on communication and computing technology today than in 1990 too. Are you worried about that? I’m not either.

The trouble is, we also have evidence that the health system is riddled with inefficiencies. It may still be worth the money, but we’re still wasting a lot. And, we’re paying for a lot of it by borrowing. Even if that’s not a problem now, it one day will be.

The bulk of the paper is about what drives increases in health spending. To explain changes in something, you need to point to other things that both cause that something and are themselves changing and in the right direction. You can’t explain growth with static phenomena or phenomena that change in such a way to suggest reduction, not growth. So, for example, the tax subsidy of employer-sponsored health insurance can help explain the level of health spending, but not its growth. Marginal tax rates have largely fallen over the decades of high health spending growth. If anything, that should decrease the level of health spending encouraged by the preferential treatment of employer-sponsored health insurance.

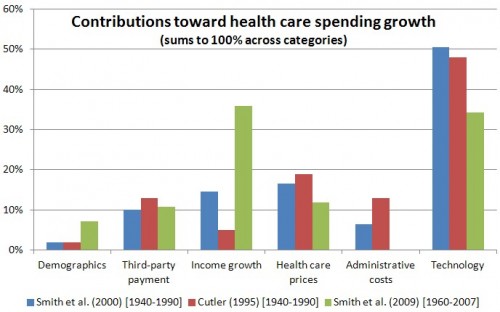

Of course, you can read Newhouse’s paper for yourself to see what he thought in 1992 about what drives increasing health spending. But, there is more recent work, and I’ve summarized it in a recent post.

Technology is obviously the safe bet for a huge driver, with income growth also playing a large role in the most recent study. Health care prices and third-party payment deserve a fair amount of blame and also receive quite a bit of focus. The gestalt of the studies suggests we probably devote an unreasonable amount of attention to demographic change and administrative costs.

That’s worth remembering. A lot of the health care policy debate forces a focus on demographic change (principally, aging and longevity and what they mean for Medicare) and administrative costs (are public costs lower than private or vice versa?). Our attention is drawn to these issues because of the somewhat arbitrary boundaries we choose to recognize. We tend to believe that Medicare and Medicaid are public spending and commercial market spending is not. This is largely fiction.

As I wrote in a recent post at JAMA,

Because wages are taxed, compensation in the form of health insurance in lieu of wages reduces government revenue. In fact, it reduces it a lot: $250 billion per year. Just to put that figure in perspective, $250 billion is almost half the Medicare budget. It is more than 3½ times the average annual cost of the Affordable Care Act’s low-income health insurance subsidies. Employer-sponsored health insurance is among the most subsidized types of health insurance in America, almost as subsidized as Medicaid.

Neither the employer-sponsored tax subsidy nor public health programs are fully financed by government revenue. More than we often realize, apart from the uninsured and those with private insurance unrelated to employment, we’re all contributing to rising health care-related federal debt. If we have decent insurance, we have access to and will likely one day use advanced medical technology. It and the other drivers of health care spending are drivers of debt, even when mediated by “private” health insurance. Medicare and Medicaid are not uniquely to blame.