ACOs will receive expedited antitrust review if they fall outside of the future ACO antitrust safe harbor rule (House Judiciary Committee testimony here; see also Bloomberg and WSJ).

As I’ve blogged here recently, ACOs only need antitrust exceptions when they aren’t a single firm. Medicare-only ACOs should get a stay-out-of-jail free card as well, since the sole customer is a price-fixer. But many network ACOs will want to jointly contract with private payors, claiming partial clinical or financial integration. Antitrust law permits this only if consumers are likely to benefit from improved quality, lower costs, or both.

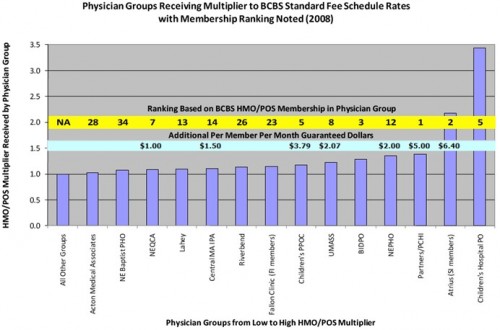

Atrius Health is already a model network ACO, with enough clinical and financial integration to jointly contract with private payers. The CEO of Atrius gave a presentation at an ACO seminar this week detailing their impressive plans. What he didn’t say was that Atrius is the second most expensive medical group in Massachusetts. Atrius used their market clout to win a huge fee multiplier from BCBS-MA, according to the 2010 Report from the Massachusetts AG: [Atrius multiplier is second from the right]

Which begs two questions: (1) how exactly will ACOs save consumers money?; and (2) if existing groups like Atrius satisfy antitrust rules, why do we need more flexible standards?

My previous TIE posts on ACOs are here, here, here, and here.