Adrianna McIntyre and Josh Fangmeier just published a data- and chart-rich post on income and age characteristics of the individual market. It adds considerable detail to the plight of the bros. Go read it!

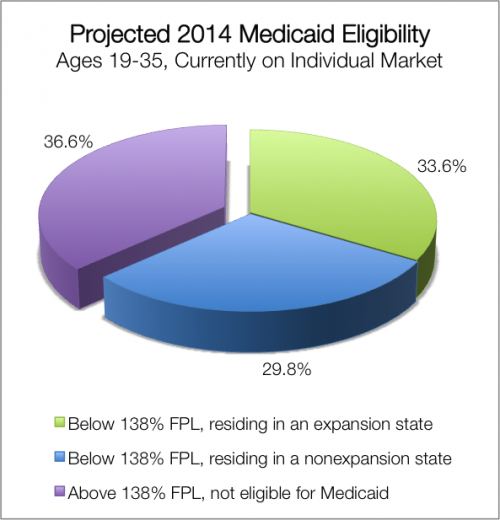

Here’s just one chart that shows that about 30% of those 19-35 years old and in the individual market today (i.e., enrolled in an individual market insurance product*) reside in states that will not be expanding Medicaid:

Of course, those under 26 years old are eligible to enroll in their parents’ plans. Adrianna and Josh write,

It’s difficult to predict how many of them will take advantage of the under-26 provision; we don’t have data about their parents’ income or insurance status. Given those caveats, I understand if you wanted to ignore that age group. Eliminating them from the analysis entirely, we would still see over one-third of the individual market, ages 26-35, qualify for Medicaid in 2014 (yep, we have a pie chart for that, too).

Of that one-third, 44% reside in states not intending to expand Medicaid. This Medicaid expansion thing is a really big deal!

Acknowledging that there will be some for whom the cost of insurance will rise — “rate shock” — there clearly will be others for whom the lack of availability of affordable insurance will be a surprise. Unfortunately, those who would be eligible for, but are denied access to, Medicaid coverage are also those most in need of assistance. I don’t deny the freedom for others to choose what is most shocking to them about the inequities of ObamaCare. But to me, and in a country of our wealth, it’s this.

* See comments for a discussion of this.