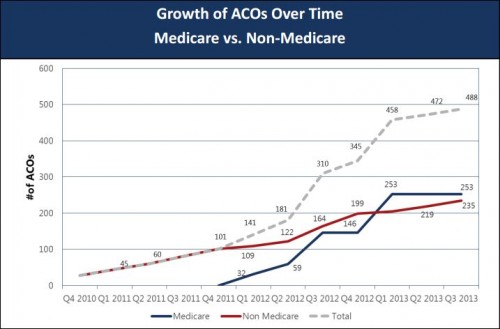

A look at ACO growth from Matthew Petersen, David Muhlestein, and Paul Gardner (PDF) of Leavitt Partners:

A few observations:

- Non-Medicare is not defined. In theory it could include Medicaid. It almost certainly includes commercial market organizations. As such, because there were some non-Medicare ACOs before the start of 2012, ACOs were not a government idea. (This does not, by itself, make them a good or bad idea.)

- Non-Medicare ACOs and Medicare ACOs exist in nearly equal numbers. I understand why Medicare is promoting ACOs. But, because they encourage provider integration, which could lead to higher prices and premiums, I do not understand why private insurers would be. (Not all non-Medicare ACOs are private-insurer sponsored, but many are.)